502 , GTH Bldg, Alzahiya, Abu Dhabi, UAE

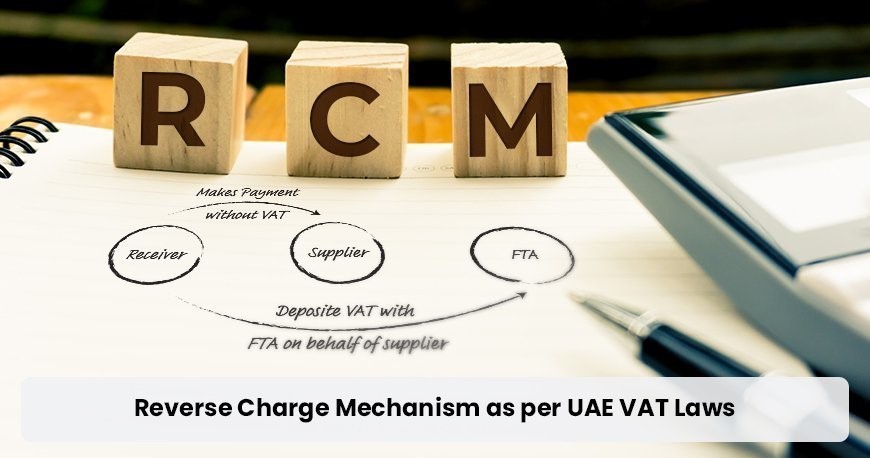

The Reverse Charge Mechanism (RCM) is a critical concept in the UAE VAT system, applicable to certain transactions where the buyer, rather than the seller, accounts for the VAT. When dealing with RCM, businesses must carefully apportion input VAT to ensure accurate compliance and financial reporting. Here’s an explanation of how the apportionment method applies to RCM, including a practical example.

What is the Reverse Charge Mechanism (RCM)?

The RCM shifts the responsibility for accounting for VAT from the supplier to the recipient of goods or services. This mechanism typically applies to:

- Imported goods and services

- Transactions between VAT-registered businesses in different GCC states (once the GCC VAT system is fully implemented)

According to accounting services in Abu Dhabi under RCM, the buyer records the VAT on both the purchase (input VAT) and the sale (output VAT), ensuring no net VAT impact but facilitating proper accounting and reporting.

Apportionment of Input VAT under RCM

When a business uses the apportionment method for input VAT, it must also apply this method to RCM transactions. The goal is to allocate the input VAT on RCM supplies between taxable and exempt supplies accurately.

Steps for Apportioning Input VAT under RCM

- Identify Total Input VAT: Determine the total input VAT incurred on all purchases, including RCM transactions.

- Direct Attribution: Attribute input VAT directly to taxable supplies, exempt supplies, and RCM supplies where possible.

- Apportion Remaining Input VAT: Use an appropriate apportionment method (standard, direct attribution, or special method) to allocate the remaining input VAT between taxable and exempt supplies.

Example of Apportioning Input VAT under RCM Using the Standard Input-Based Method with Annual Washup

The standard input-based method for apportioning input VAT focuses on the ratio of the value of taxable supplies to the total supplies made by the business. This method ensures that businesses proportionally recover input VAT based on their taxable activities. Here’s a detailed example illustrating this approach, including an annual washup to adjust for any discrepancies.

Scenario

Let’s consider a business that imports goods and services subject to RCM and makes both taxable and exempt supplies. The figures for the fiscal year are as follows:

- Total value of taxable supplies: AED 600,000

- Total value of exempt supplies: AED 200,000

- Total value of all supplies (taxable + exempt): AED 800,000

- Total input VAT incurred (excluding RCM): AED 60,000

- Total input VAT on RCM supplies: AED 15,000

Steps for Apportioning Input VAT Using the Standard Input-Based Method

- Identify Total Input VAT: Determine the total input VAT incurred, including VAT on RCM supplies with professional consultancy firm in Abu Dhabi.

- Direct Attribution: Allocate input VAT directly attributable to taxable supplies and exempt supplies.

- Apportion Remaining Input VAT: Use the standard input-based method to apportion the remaining input VAT.

- Annual Washup: Adjust for any discrepancies at the end of the year to ensure accurate VAT recovery.

Step-by-Step Calculation

- Identify Total Input VAT:

- Total input VAT (excluding RCM): AED 60,000

- Total input VAT on RCM supplies: AED 15,000

- Total input VAT incurred: AED 75,000 (AED 60,000 + AED 15,000)

- Direct Attribution:

- Directly attributable input VAT to taxable supplies: AED 25,000

- Directly attributable input VAT to exempt supplies: AED 10,000

- Apportion Remaining Input VAT:

- Remaining input VAT to be apportioned: AED 40,000 (AED 75,000 – AED 25,000 – AED 10,000)

- Calculate the ratio of taxable supplies to total supplies: AED 600,000 / AED 800,000 = 0.75

- Apportioned input VAT to taxable supplies: 0.75 * AED 40,000 = AED 30,000

- Apportioned input VAT to exempt supplies: 0.25 * AED 40,000 = AED 10,000

- Annual Washup:

- At the end of the fiscal year, recalculate the actual proportion of taxable to total supplies and adjust accordingly.

- Assume the actual proportion of taxable supplies changes slightly to 0.72 due to business fluctuations.

- Recalculate apportioned input VAT based on the new proportion:

- Apportioned input VAT to taxable supplies: 0.72 * AED 40,000 = AED 28,800

- Apportioned input VAT to exempt supplies: 0.28 * AED 40,000 = AED 11,200

- Adjust the previously apportioned amounts to match the new calculations:

- Adjusted input VAT to taxable supplies: AED 28,800 (new) – AED 30,000 (initial) = -AED 1,200

- Adjusted input VAT to exempt supplies: AED 11,200 (new) – AED 10,000 (initial) = +AED 1,200

Final Allocation:

- Total recoverable input VAT for taxable supplies: AED 25,000 (direct) + AED 28,800 (apportioned) = AED 53,800

- Total non-recoverable input VAT for exempt supplies: AED 10,000 (direct) + AED 11,200 (apportioned) = AED 21,200

- Total recoverable input VAT on RCM supplies: AED 15,000

Example of Apportioning Input VAT under RCM Using the output-Based Method

Let’s consider an example to illustrate how to apply the apportionment method to RCM transactions.

Scenario:

- A business imports goods worth AED 100,000 and services worth AED 50,000, both subject to RCM.

- The total input VAT on these imports is AED 7,500 (5% of AED 150,000).

- The business makes both taxable and exempt supplies.

- Total taxable supplies: AED 400,000

- Total exempt supplies: AED 100,000

- Total input VAT from other purchases: AED 20,000

Steps:

- Identify Total Input VAT:

- Total input VAT (including RCM): AED 7,500 + AED 20,000 = AED 27,500

- Direct Attribution:

- Directly attributable input VAT to taxable supplies: AED 12,000

- Directly attributable input VAT to exempt supplies: AED 3,000

- Directly attributable input VAT to RCM supplies: AED 7,500

- Apportion Remaining Input VAT:

- Remaining input VAT: AED 5,000 (AED 27,500 – AED 12,000 – AED 3,000 – AED 7,500)

- Apportion using the standard method based on the proportion of taxable supplies to total supplies:

- Proportion of taxable supplies: AED 400,000 / (AED 400,000 + AED 100,000) = 4/5

- Apportioned input VAT to taxable supplies: 4/5 * AED 5,000 = AED 4,000

- Apportioned input VAT to exempt supplies: 1/5 * AED 5,000 = AED 1,000

Final Allocation:

- Input VAT recoverable for taxable supplies: AED 12,000 (direct) + AED 4,000 (apportioned) = AED 16,000

- Input VAT not recoverable for exempt supplies: AED 3,000 (direct) + AED 1,000 (apportioned) = AED 4,000

- Input VAT on RCM supplies (recoverable): AED 7,500

Conclusion

Proper apportionment of input VAT, including RCM transactions, is crucial for VAT compliance in the UAE. Businesses must accurately allocate input VAT to avoid financial discrepancies and ensure regulatory adherence. Tax consultancy firms in Dubai (ADMA) provide expert VAT services, guiding businesses through complex VAT requirements, including RCM and input VAT apportionment. For more information and tailored advice, follow us on social media and visit our website.

For detailed guidance on VAT apportionment and RCM compliance, contact ADMA Consulting today!